An Expert Insight by HR Legal Experts

The landscape of employment and labour regulation in India is undergoing one of its most significant transformations with the introduction of the four consolidated Labour Codes, designed to replace 29 existing labour laws. Although nationwide implementation awaits state-level notifications, businesses, particularly MSMEs and startups, must begin aligning their internal systems with these impending legal reforms. At HR Legal Experts, we work closely with emerging companies to ensure they remain compliant, risk-aware, and audit-ready under the evolving labour and employment framework.

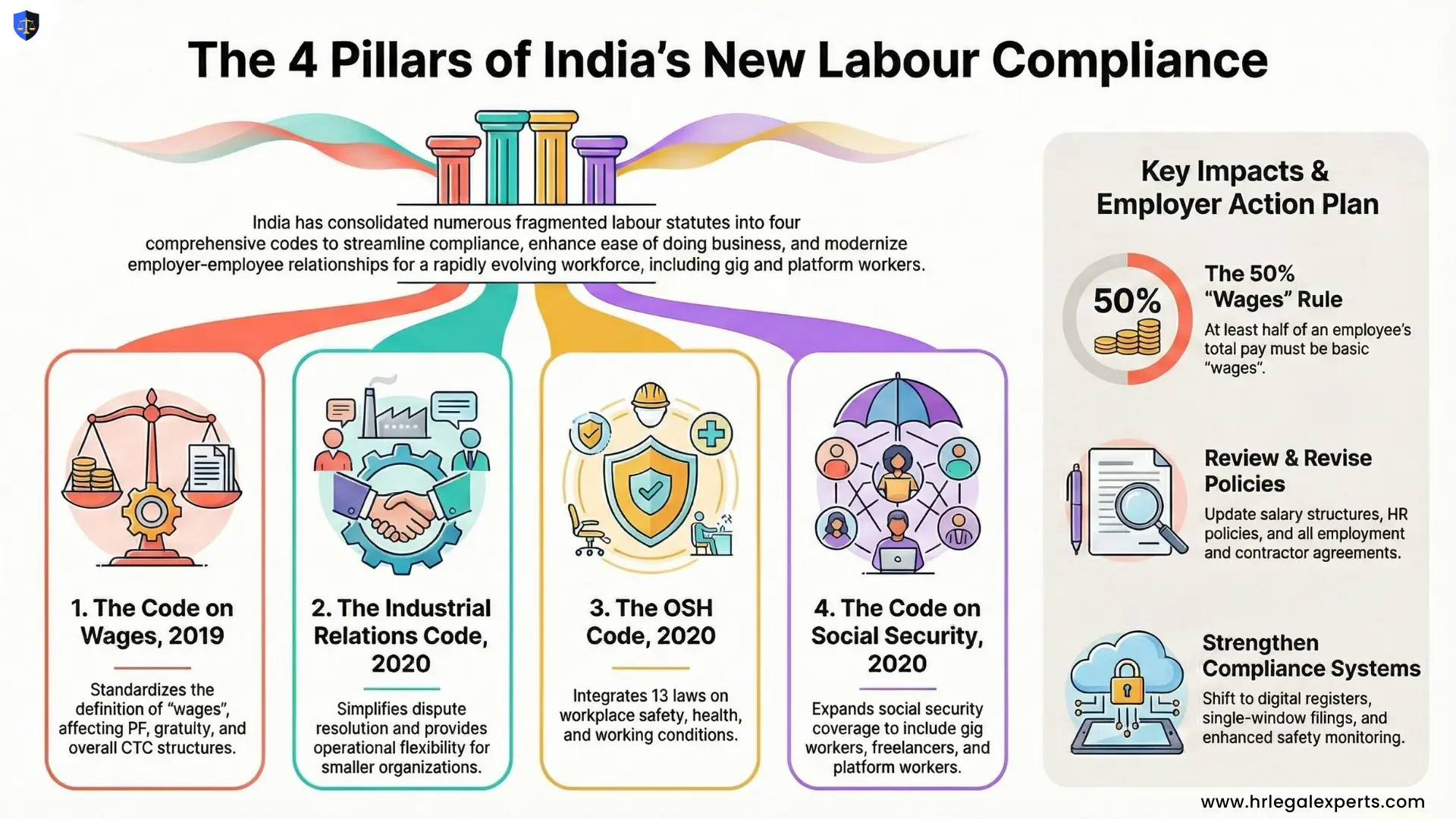

A New Era of Labour Compliance

The primary objective behind consolidating numerous labour statutes into four comprehensive codes is to streamline compliance, reduce fragmentation, and enhance the ease of doing business. For MSMEs and startups, many of which operate with lean HR structures, these changes offer an opportunity to formalise internal processes and mitigate legal exposure. The new codes create uniform definitions, integrate multiple registrations, digitise filings, and widen the scope of social security, thereby reshaping the employer-employee relationship in India.

1. The Code on Wages, 2019

The Code on Wages brings together laws relating to minimum wages, payment of wages, bonuses, and equal remuneration. One of the most impactful changes is the standardised definition of “wages”, affecting PF, ESI, gratuity, bonus computation, and CTC structuring. With the 50% rule mandating that at least half of an employee’s remuneration be classified as “wages,” companies may need to revisit compensation structures to ensure statutory compliance. The Code also enforces timely wage payments and mandates minimum wage applicability across all categories of employees, including managerial staff. At HR Legal Experts, we advise companies on restructuring payroll, reviewing employment contracts, and aligning financial practices with the new statutory definition to prevent future disputes and liabilities.

2. Industrial Relations Code, 2020

The Industrial Relations (IR) Code consolidates laws governing trade unions, Standing Orders, and industrial dispute resolution. It introduces a 14-day mandatory notice period for strikes and raises the threshold for Standing Orders to establishments with 300 or more workers, thereby offering operational flexibility to smaller organisations. The IR Code aims to create a balanced framework by simplifying dispute-handling processes while promoting predictability and transparency. Startups undergoing rapid workforce expansion, restructuring, or reorganisation can benefit from early legal strategy and documentation support. HR Legal Experts assists organisations in designing compliant internal policies and employee conduct frameworks aligned with the IR Code.

3. Occupational Safety, Health and Working Conditions (OSH) Code, 2020

The OSH Code integrates 13 diverse legislations related to workplace safety, health standards, contract labour, and migrant workers. It mandates a single registration for businesses, introduces digitised registers, and requires free annual health check-ups for certain categories of employees. The Code also enhances protections for contract labour and places stronger responsibility on employers to provide a safe working environment.For IT companies, SaaS enterprises, and hybrid-work organisations, compliance goes beyond physical office safety. At HR Legal Experts, we help companies establish comprehensive OSH-compliant frameworks covering remote work policies, workplace safety documentation, vendor compliance, and statutory registers.

4. Code on Social Security, 2020

The Social Security Code is one of the most forward-looking reforms, expanding coverage to gig workers, platform workers, fixed-term employees, freelancers, and contract staff. It aims to create a unified mechanism for PF, ESI, maternity benefits, gratuity, employee insurance, and other welfare schemes. Notably, fixed-term employees may now be entitled to gratuity irrespective of the traditional five-year rule. Given the increasing reliance of startups on gig-based roles and freelance workforce, this Code triggers the need for updated contracts, revised HR policies, and budgetary planning. We support companies in drafting compliant agreements and establishing systems that align with the broadened definition of “employment” under the Code.

To ensure seamless adoption of the new Labour Codes, businesses should initiate the following steps:

• Review salary structures as per the 50% wages rule

• Update HR policies, employment agreements, and contractor documentation

• Reassess gig-worker, freelancer, and consultant engagements

• Prepare for enhanced PF, ESI, and gratuity liability

• Shift towards digital registers and single-window compliance systems

• Strengthen workplace safety, grievance redressal, and compliance monitoring

A proactive approach today will prevent compliance backlogs and litigation risks once the codes become fully enforceable.

The new Labour Codes represent a modern, unified, and compliance-focused framework for India’s rapidly evolving workforce. For organizations, these reforms are not only regulatory changes but also an opportunity to institutionalise robust employment practices, reduce legal risks, and enhance organisational governance. As labour laws move toward nationwide implementation, HR Legal Experts stands ready to support businesses with end-to-end compliance advisory, policy drafting, and labour law audits tailored to the needs of emerging enterprises.

For professional assistance in reviewing your HR policies, employee contracts, or compliance preparedness, feel free to connect with our team.

FAQs: What Businesses and Employers Most Commonly Ask

Labour Codes Questions

The government notified the Four Labour Codes, which became effective from 21 November 2025.

Yes. Under the Social Security Code, categories such as gig workers, platform workers, fixed-term employees, freelancers and contract staff are now covered under social security, including PF, ESI, gratuity, and other welfare schemes.

The Code defines “wages” uniformly, and remuneration components like HRA, allowances, etc., are restructured so that at least 50% of an employee’s pay qualifies as “wages.” This affects how PF, gratuity, bonus and other statutory payments are calculated.

Yes. Given expanded coverage (gig/freelancers), new definitions (wages), and employer obligations (safety, social security), contracts and HR policies need updating to stay compliant.

Yes. One goal of the reforms is to simplify previously fragmented regulations. Unified codes reduce paperwork, offer digital/filer-based compliance, and aim to improve ease of doing business while ensuring worker protections.

No. The OSH Code extends to all workplaces covered under the law, including service-sector organisations, remote-work setups, and companies with hybrid/remote working models. Employers must ensure safety norms and maintain the necessary registers.

HR Legal Experts is a specialized consulting firm helping businesses stay fully compliant with labour laws and HR policies. With a proven track record of serving 500+ organizations, we deliver customized solutions in POSH compliance, employee handbooks, contracts, and regulatory documentation. Our team combines legal expertise with practical HR insights to ensure risk-free, people-first workplaces.