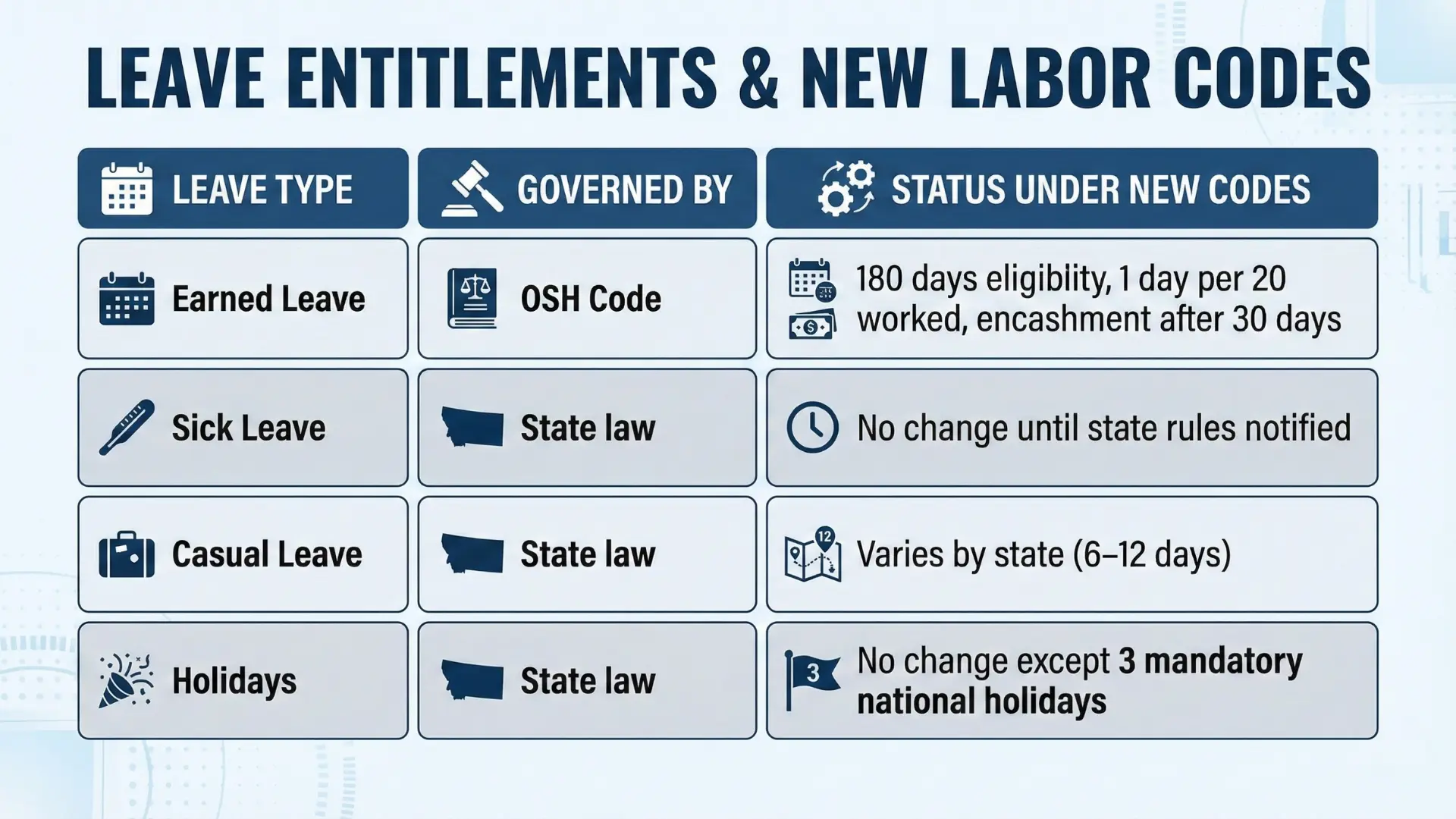

India’s shift to the leave rules under new labour codes 2026 introduces major updates to annual leave, sick leave, casual leave, and employer compliance requirements across the country. These codes were introduced to simplify India’s complex patchwork of labour laws, improve compliance, protect workers’ rights, and offer employers a more uniform framework in which to operate. Leave rules, often a confusing mix of central and state-level provisions, now receive greater clarity through the Occupational Safety, Health and Working Conditions (OSH) Code.

While implementation timelines depend on state notifications, employers and HR teams must begin preparing. This detailed guide breaks down leave rules under the new Labour Codes 2026, focusing on how eligibility, accrual, encashment, and compliance obligations are expected to evolve.

Scope of Leave Coverage Under the New Labour Codes 2026

Under India’s previous legal landscape, leave rules were scattered across multiple laws: the Factories Act, various state Shops & Establishments Acts, and sector-specific laws. This often resulted in inconsistent policies within the same organisation operating across multiple states.

The leave rules under new labour codes 2026 aim to simplify long-standing inconsistencies by offering standardised earned leave provisions while still allowing states to regulate certain categories like sick leave and casual leave.

The new OSH Code seeks to streamline many of these inconsistencies by:

• Standardising earned leave eligibility

• Defining minimum leave entitlements

• Providing uniformity for establishments covered under the Code

• Retaining state authority for certain leave categories

Importantly, while the Code provides a central structure, state governments still hold the power to issue their own rules. This means employers must harmonise central guidelines with state notifications until full alignment is achieved.

The new labour codes India 2026, therefore, create a hybrid model: centralised for some leave types, decentralised for others.

Earned Leave (Annual Leave) — What Has Changed?

Earned leave, also known as annual leave, is one of the most utilised and tightly regulated categories in India. The new Codes attempt to make earned leave more accessible and fair.

1. Eligibility Reduced From 240 Days to 180 Days

Previously, employees needed to complete 240 working days in a year to qualify for earned leave.

Under the OSH Code, this is now reduced to 180 days, which is particularly beneficial for:

• Fixed-term employees

• Contract workers

• Seasonal or project-based workers

• Newly hired employees who become eligible sooner

This shift recognises India’s modern workforce patterns, where many employees work on shorter-term assignments.

2. Accrual Rate Remains the Same

Employees continue to earn 1 day of leave for every 20 days worked, maintaining familiarity while offering improved access due to the reduced eligibility threshold.

3. Leave Encashment Requirements Strengthened

The Code mandates that earned leave exceeding 30 days must be encashed.

This prevents:

• Excessive accumulation

• Cash-flow issues during employee exits

• Ambiguity around long-term leave liabilities

Encashment is now more formalised, reducing disputes between employees and employers.

4. Carry-Forward of Leave

The OSH Code allows employees to carry forward unused earned leave, subject to employer policy. With many states yet to notify rules, HR teams must draft clear policies to avoid misinterpretation.

Sick Leave: Still Governed by State Regulations

Sick leave remains one of the areas not standardised under the central Codes.

It continues to be governed by state Shops & Establishments Acts until states issue revised rules under the new framework.

What this means for employers:

• Sick leave entitlements may vary by state (usually 6 to 12 days).

• Employees in multi-state organisations may have different sick leave rules depending on their work location.

• HR teams must maintain a state-specific leave compliance sheet to avoid under- or over-provision of leave.

Many companies voluntarily unify sick leave policies across locations, but state rules continue to apply.

Casual Leave and Holidays: No Immediate Central Change

Casual leave is for short, unforeseen absences and, like sick leave, is a state-governed leave type.

Common state variations include:

• 6 days

• 8 days

• 12 days

The new Codes do not change this, allowing states to retain flexibility.

Holiday Rules

The Codes do not modify holiday structures. Employers must still comply with:

• 3 mandatory national holidays (Republic Day, Independence Day, Gandhi Jayanti)

• State-notified festivals and public holidays

Restrictions on requiring employees to work on national holidays remain unchanged, unless double wages or compensatory leave are provided.

Practical Impact for Employers

Even though not all leave types are centralised, the new labour codes India 2026 require employers to strengthen HR operations, documentation, and payroll systems.

As the leave rules under new labour codes 2026 move closer to implementation, employers must realign HR policies, leave registers, and compliance systems to meet updated eligibility and documentation expectations.

Employers should focus on:

1. Updating HR Policies

Policies must reflect the 180-day eligibility, accrual rules, and encashment provisions.

Clear documentation helps avoid grievances and ensures audit readiness.

2. Monitoring State Notifications

Until states adopt uniform rules, HR teams must track updates and adjust policies accordingly.

3. Revising Attendance and Leave Management Systems

Systems must automate:

• Eligibility checks

• Accrual calculations

• Encashment triggers

• Record-keeping requirements

4. Compliance With Working Hours and Overtime Provisions

The Codes also introduce flexibility in working hours (such as a 4-day work week) while keeping weekly hours capped at 48. Leave and attendance systems must align with these changes.

5. Strengthening Record-Keeping

Accurate leave registers, working-hour logs, and employee records are essential for compliance and inspections under the OSH Code.

Impact on Employees

From an employee perspective, the new leave structure offers:

• Faster eligibility for annual leave

• More transparent entitlements

• Improved financial benefits through mandatory leave encashment

• Better protections for fixed-term workers

• Greater predictability in multi-state organisations

The long-term goal is to build a fair and uniform leave ecosystem across industries.

FAQs: Frequently Asked Questions

No, they do not increase the number of earned leave days. They primarily change eligibility and encashment criteria.

Only when states notify their rules. Until then, sick leave remains governed by state-specific Shops & Establishments Acts.

Yes, the Codes allow flexible distribution of working hours as long as the weekly limit of 48 hours is respected.

No. Leave entitlements under the OSH Code apply only to employees, not gig or platform workers.

No, earned leave accumulates under employment tenure. Only sick and casual leave rules may differ based on state policies.

Yes. Earned leave beyond 30 days must be encashed to ensure transparency in payouts.

Absolutely. Automated attendance, leave tracking, and audit logs will become essential for inspections and compliance readiness.

HR Legal Experts is a specialized consulting firm helping businesses stay fully compliant with labour laws and HR policies. With a proven track record of serving 500+ organizations, we deliver customized solutions in POSH compliance, employee handbooks, contracts, and regulatory documentation. Our team combines legal expertise with practical HR insights to ensure risk-free, people-first workplaces.